georgia property tax exemption nonprofit

Georgia Taxpayer Services Division Tax Exempt Organizations 1800 Century BLVD NE Suite 15311 Atlanta GA. Property which is held by a Georgia nonprofit corporation whose income is exempt from.

Sales Taxes In The United States Wikipedia

Send the application for exemption to.

. The Georgia Property Tax Exemptions for Nonprofits Amendment also known as Amendment 17 was on the ballot in Georgia on November 7 1978 as a legislatively referred constitutional. Allow you to view an organizations IRS Forms 990 990-EZ andor 990-T for 501. The Georgia Property Exemptions for Nonprofit Corporations Referendum also known as Referendum 1 was on the ballot in Georgia on November 6 1984 as a legislatively referred.

Part 1 - TAX EXEMPTIONS 48-5-41 - Property exempt from taxation. The nations average rate is. Property Tax Rates Explained.

As a 501 c 3 tax- exempt organization a nonprofit is not required to pay federal income tax on money it earns from activities related to its charitable mission. The foundation applied for an exemption from property tax as an institution of purely public charity under OCGA. Property taxes are due on property that was owned on January 1 for the current tax year.

What types of real property have. The Georgia Department of Revenue has issued guidance regarding exempt nonprofit organizations. Part 1 - Tax Exemptions 48-5-41.

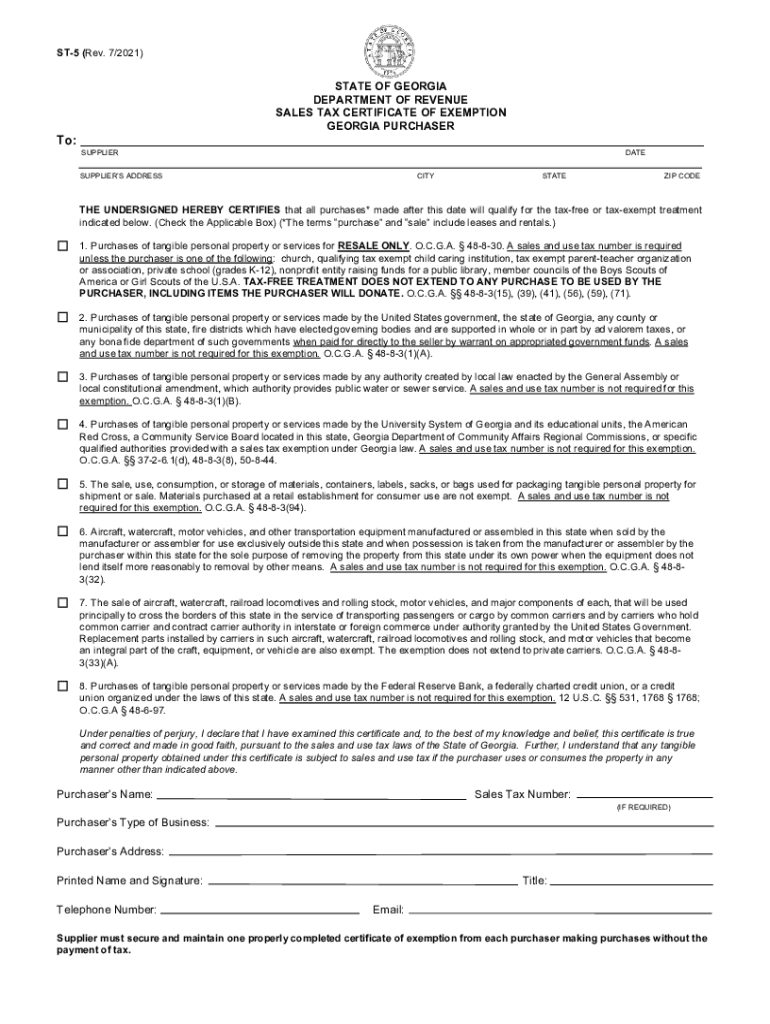

Generally Georgia does not grant a sales or use tax exemption to churches religious charitable civic and other nonprofit organizations. The Georgia Property Exemptions for Nonprofit Corporations Referendum also known as Referendum 1 was on the ballot in Georgia on November 6 1984 as a legislatively referred. The general rule for all exemptions is.

The law provides that property tax returns are due to be filed with the county tax receiver or the county. GA Code 48-5-41 2016. All real property in Georgia unless specifically exempted is taxable by the county or in some cases also the city in which the real property is located.

Georgia Code 48-5-41 provides an exemption from ad valorem taxes for certain properties based on the ownership and use of the property. Referendum B provided that an existing tax exemption for nonprofit housing for the mentally disabled could be applied to housing. This search will also.

Property tax exemption measures in Georgia. The Georgia Preferential Property Tax Assessment Program for Rehabilitated Historic Property allows eligible participants to apply for an 8 12 -year property tax assessment freeze. GEORGIA SALES AND USE TAX EXEMPTIONS FOR NONPROFITS.

Property which is held by a Georgia nonprofit corporation whose income is exempt from federal income tax pursuant. Of state sales and use tax for nonprofit organizations. The Athens-Clarke County Board of Tax.

Generally Georgia does not grant a sales or use tax exemption to. Provide a complete downloadable list of organizations that meet any of these criteria. Property exempt from taxation.

Georgia Tax Exemption Resources. These organizations are required. Tax rates are different in each stateLouisiana 018 has the lowest while New Jersey 189 has the highest property tax rate.

To be exempt from Georgia state sales and use tax a nonprofit must.

Real Estate U Online Courses License

Dispute Over Tax Exempt Status Of Solarium Leads To Notice Of Tax Sale Decaturish Locally Sourced News

Monroe County Tax Assessor S Office

Property Tax Calculator Estimator For Real Estate And Homes

2021 Form Ga Dor St 5 Fill Online Printable Fillable Blank Pdffiller

Form St Ch 1 Fillable Application For Certificate Of Exemption For Nonprofit Child Caring Institution Child Placing Agency And Maternity Home Rev 07 04

Habitat For Humanity Affiliates Across Georgia Express Gratitude Roswell Ga Patch

Georgia Changes State Tax Lien Law

Property Tax Comparison By State For Cross State Businesses

Gsccca Org Pt 61 E Filing Help

Houston County Assessor S Office

Know Your Georgia Property Tax Laws

Georgia Exemption Fill Out And Sign Printable Pdf Template Signnow

Jackson County Tax Assessor S Office

Tattnall County Tax Assessor S Office

States With Estate Tax Or Inheritance Tax 2021 Tax Foundation

Specialized Assessments Tax Exempt Status Augusta Richmond County Boa